Adrian Rosebrock

Hi, I’m Adrian — a computer science PhD who decided that successfully selling an AI company wasn’t enough of a midlife crisis. So naturally, I’m now a quant trader attempting to turn Python code and probability theory into market-beating returns.

(My therapist calls it “an exercise in productive self-sabotage”)

Watch me turn $25K and Python code into either a hedge fund origin story...or a masterclass in optimizing dumpster fires.

Instead of following conventional wisdom and buying index funds, I’m attempting to beat the market with algorithms and $25,000 of my own money. Every trade, balance sheet, and questionable decision — documented in real-time with complete transparency.

"Truly, this is a train wreck of an idea. Have you considered taking up gardening instead?" — Warren Buffett (probably)

"I showed your trading strategy to my church prayer group. They've added you to the list." — My mom

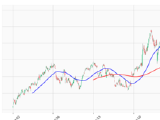

Trading Performance (Year to Date)

PythonFinTech Fund vs. S&P 500

| PythonFinTech | S&P 500 | |

|---|---|---|

| Total Return (YTD) | 3.8% | -4.86% |

| CAGR | 8.28% | -10.1% |

| Max Drawdown | -4.31% | -18.76% |

| Volatility (Ann.) | 10.25% | 29.86% |

| Sharpe Ratio | 1.18 | -0.37 |

| Sortino Ratio | 1.91 | -0.56 |

| Calmar Ratio | 1.92 | -0.54 |

| Ulcer Index | 2.05% | 7.69% |

| R² (vs Benchmark) | 0.15 | nan |

Trade Metrics

| # Trades | 22 |

| Win % | 54.55% |

| Avg. Gain (%) | 4.45% |

| Avg. Loss (%) | -3.25% |

| Avg. Gain ($) | $173.04 |

| Avg. Loss ($) | $-115.63 |

| Win Loss Ratio | 1.37 |

| Expectancy Per Trade ($) | $41.83 |

| Profit Factor | 1.8 |

As of May 1, 2025, the S&P 500 is down -4.86%, while my fund is up 3.8%, resulting in an outperformance of 8.86%.

With an R² value of 0.15, this implies returns are largely uncorrelated with the benchmark, meaning the strategy’s performance is primarily driven by factors independent of the overall market.

*All metrics reported are as of May 1, 2025.

"Most of my clients want to retire early. This one wants to turn Python scripts into a hedge fund. I need a drink." — My financial advisor