About

The story (warning: contains actual feelings) #

Back in 2014 I started the popular computer vision, deep learning, and OpenCV education website, PyImageSearch.

I ran PyImageSearch for eight years, growing it into the largest platform of its kind, authoring 9 books, 2 courses, and 500+ tutorials on artificial intelligence.

Then, in 2021, PyImageSearch was acquired for a life-changing amount of money.

Not “flying around in a G6” money…more like “I can afford the fancy bubble tea” money. You know, the one with extra toppings.

After the business sold, I split my money into two piles:

- Pile #1: The “responsible adult” money that went into a carefully planned, long-term investment strategy. The kind your financial advisor actually approves of.

- Pile #2: The “what could possibly go wrong” money that I decided to actively trade myself. Because apparently watching Boiler Room and the The Wolf of Wall Street qualifies as a financial education.

And hey, how bad could it really go, right?

(Narrator: It could go very bad indeed.)

“Adrian, most people just buy a sports car for their mid-life crisis” #

I’m what you’d call a crisis connoisseur – did the sports car in my 20s, divorce in my 30s, and now I’m coding trading algorithms.

Some people climb mountains, I scale bad decisions.

Back in my 20s, when I was proudly “quantitatively curious”, I was advised by experienced quant developers and hedge fund operators to not get involved in trading — it’s too cutthroat, and any profits made would be spent on tummy meds to help prevent sleepless nights caused by ulcers and projectile diarrhea.

After PyImageSearch was acquired, I was told that it would be foolish to spend any time in this space. That I wasn’t a “trained professional” (hey, if Lehman Brothers and Long-Term Capital Management can blow up their accounts, then so can I).

One helpful soul suggested “Perhaps you should go back to school to study orthodontics. You’d make more money as a dentist” (4 out of 5 dentists agree: don’t start a hedge fund).

And now that I’m 36, perhaps the only thing that can cure this itch is a hefty dose of humility served up by Mrs. Market, the sadistic dominatrix who specializes in disciplining overzealous programmers with a trading fetish.

Three years later, a weekly Amazon auto-ship order for antacids, and an embarrassing number of Python scripts later, I’ve learned a thing or two about what works (and more importantly, what spectacularly goes up in flames).

Why PythonFinTech exists #

Let’s be honest:

The world of trading and investing is full of:

- “Get rich quick” schemes that smell fishier than a 2008 mortgage-based security

- Overly complex strategies that make quantum physics look like a children’s coloring book

- Trading “gurus” who somehow always forget to show their losses.

I created PythonFinTech to be the resource I wish I had when I started — fully-transparent, code-complete, and refreshingly BS-free.

What you’ll find here #

- Monthly Brokerage Updates: Yes, I actually show my real portfolio performance. Losses and all. (My accountant thinks I’m crazy — little does he know that my mom had me tested when I was nine years old and I scored “only a little crazy”)

- Python-Powered Analysis: Real code, real strategies, real results. No black boxes.

- Zero Hype: I promise to never use the words “foolproof trading strategy” or “guaranteed returns” unironically.

What makes this different #

I’m not here to sell you the dream of becoming an overnight millionaire (though wouldn’t that be nice?)

Instead, I’m sharing my journey of building Python-driven trading systems, complete with:

- Actual portfolio performance (the good, the bad, and the “maybe I should’ve stuck to index funds”)

- Step-by-step Python tutorials for analyzing market data

- Real trade breakdowns, including the setup, why the trade was taken, etc.

- A healthy dose of self-deprecating humor, because, let’s face it — the market humbles us all

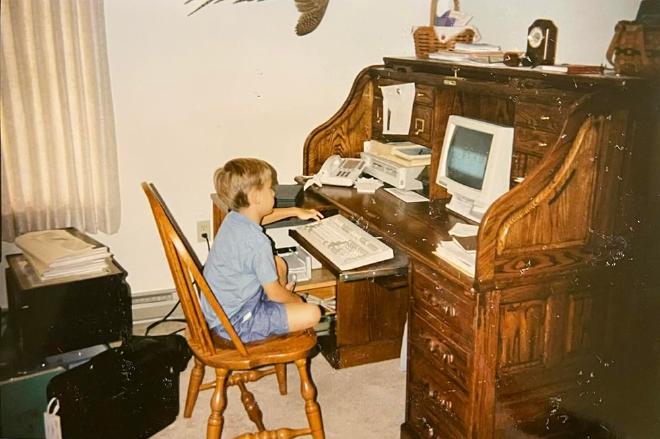

The goal (other than having kiddos with this baddie) #

My mission is simple:

Help you bridge the gap between technical knowledge and financial markets, all while maintaining enough transparency to make my compliance officer nervous (did you know there is a thing as too much sharing?)

Whether you’re a developer curious about quantitative trading, or an experienced investor looking to automate your analysis, you’ll find practical, Python-powered insights here.

No fancy suits required.

No Bloomberg Terminal necessary.

Just some coding knowledge and a questionable amount of optimism.

The road ahead #

Looking forward, my goal is to make PythonFinTech the kind of resource I wish existed when I started — where Python code meets profit, where transparency isn’t just a buzzword, and where we learn from each other’s successes and spectacular failures (including the ones that make my accountant cry).

I’ve also got a vision of spinning this whole operation into a hedge fund somewhere down the line, but let’s not get ahead of ourselves…

For now, I’m content to grind away on this passion project, sharing the knowledge I’ve picked up from the trenches over the past few years in my signature style — a mix of friendly yet hard-hitting analysis with a dash of self-effacing humor.

If Warren Buffet and Dave Chappelle had a baby (and what a sexy baby it would be), it might look something like this website: financially literate but probably inappropriate at family gatherings.

Let’s connect #

So, if you’re ready to join me in this wild ride of turning copious amounts of bubble tea and Python code into (hopefully) profitable trading strategies, buckle up and keep your arms and legs inside the algorithm at all times.

See you in the charts.

—Adrian Rosebrock

Disclaimer: This site documents my personal trading journey and code experiments. Nothing here is financial advice. While I did get a PhD in Computer Science, my financial education comes from the ‘Getting Cooked Academy’, where I graduated summa cum laude in ‘Creative Ways to Lose Money’. All strategies here come with a free masterclass in ‘Fucking Around’. Don’t worry, the ‘Finding Out’ module teaches itself. Enrollment is at your own risk.