The $25,000 challenge — I'm attempting to beat the S&P 500 as a retail trader and Python coder

Table of Contents

That was the first sentence that came out of my mouth after the COO of my previous business asked why I got involved in algorithm and trading.

The thing is, I’ve always been drawn to building systems.

Give me a computer and a problem to solve, and I’ll happily spend hours coding elegant solutions.

It’s not just about the end result — it’s about the journey of creation, the satisfaction of watching something you’ve built come to life.

For eight years, I poured that passion into PyImageSearch, building it into the largest computer vision, deep learning, and OpenCV education platform online.

When it was acquired in 2021, I thought I’d found my happy ending. You know, ride off into the sunset, maybe write a memoir about how to exit a business.

In reality, what actually happened is that I solved a core childhood wound surrounding money.

That sounds great, right?

Except when you build your entire life’s purpose on one thing, and then you accomplish that thing, you’re left rudderless.

The mountain has been summited.

What now?

What’s next?

What do I do with myself, and who am I without my business?

PyImageSearch’s acquisition was a stage of letting go:

- Of the company I spent eight years pouring my heart and soul into

- Of a marriage that no longer served me or my ex-wife

- Of the country I grew up in and once called home (I left the USA two years ago)

All of those were painful.

Excruciating even.

Looking back, the past three years have been the most challenging of my adult life.

At times I was listless and restless, completely lost.

But creators can’t stop creating. It’s in our DNA.

After a few years of “retirement” (which mostly involved building a number of one-off projects for fun), I found myself drawn to the world of algorithmic trading.

It wasn’t just the potential returns that caught my attention — it was the perfect intersection of everything I love: coding, problem-solving, and the opportunity to build something meaningful.

The parallels between computer vision and algorithmic trading are surprisingly strong. Both fields require you to take noisy, complex data and transform it into meaningful insights.

Whether you’re detecting objects in images or identifying trading opportunities in market data, the fundamental challenge remains the same: can you build robust systems that perform reliably in the real world?

For the past three years, I’ve been quietly developing and testing trading algorithms as a hobby project.

The past 10 months I got a bit more series about algorithmic trading…and then something interested happened.

I started feeling that same spark of excitement I felt in the early days of PyImageSearch.

That deep sense of curiosity, the joy of solving complex problems, and most importantly, the desire to share what I’m learning with others.

So, I’ve decided to do something a bit crazy (or maybe a lot crazy), depending on who you ask:

Complete transparency. Real results. No hype.

Just me, betting on myself once again.

Why start this challenge now? #

You want my opinion on startups in the tech scene?

Okay, here it is:

The current landscape of entrepreneurship, especially in tech, feels like trying to build a sandcastle in a hurricane.

I’ve spent a lot of time sitting and reflecting on what to build next.

I even built and launched number of projects, including:

- A podcast helping tech bloggers grow and monetize their sites

- An AI-based SaaS tool that automatically generates technical documentation

- A consulting company helping non-technical founders implement AI solutions

- An app that recognizes prescription pills in the snap of a smartphone camera

Each had potential.

Each could have been a viable business.

But here’s the problem — the world of online businesses has fundamentally shifted, largely due to generative AI:

- Information products (in their current form) are dying. ChatGPT and other LLMs can generate technical tutorials, explanations, and documentation that are good enough for most people (PyImageSearch was essentially an information product business, for what it’s worth).

- SEO is a bloodbath. Google’s AI-first approach has decimated organic traffic for many websites. I know founders who have lost 15-80% of their click-through rates overnight (I’m not the only founder who feels this way — check out Rob Walling’s podcast episode, 9 Startup Predictions for 2025).

- The SaaS middle-ground is evaporating. On one end, you have no-code and low-code tools letting non-technical founders launch $1-10K/month micro-SaaS businesses. On the other end, you need significant capital to complete with established players in the never-ending game of “platform risk”. The middle of the bell curve is disappearing. It’s my prediction that building a $1M+/year SaaS as a solo founder or a small team will become near impossible in the coming years.

- AI startups are getting wiped faster than my trading account during my first month of algorithmic trading. Every time OpenAI, Anthropic, or Google releases an update, another batch of AI services become obsolete. Just look at what happened to vector embedding companies and RAG services in late-2023/early-2024.

But trading?

I see trading as different.

Markets don’t care if you use generative AI, traditional algorithms, or tea leaves to make decisions. The only thing that matters is whether your strategy works.

Furthermore, generative AI democratizes trading, allowing retail traders the ability to move and act on insights that were only previously available to institutional funds.

More importantly, I want do something that is as transparent as reasonably possible.

The trading space is plagued by:

- Self-proclaimed gurus selling dreams of “becoming an overnight millionaire” (that’s not even legal to claim, FWIW)

- “Proprietary systems” that are never actually revealed

- Claims of massive returns with zero proof

- Cooked books that share positive returns, but somehow always seem to omit the drawdowns

I want to build something different — a resource where people can follow along, learn from both my successes and failures, and see exactly what it takes to build a quantitative trading operation from the ground up.

No smoke and mirrors. No hidden agendas. Just real trading, real code, and result results.

The time feels right. I’ve laid the foundation. Now it’s time to execute.

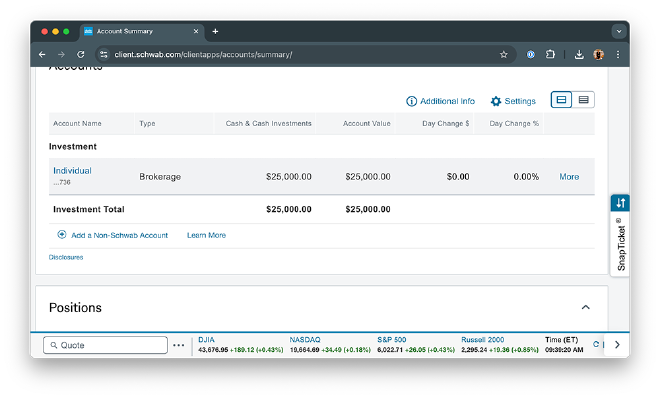

The $25,000 trading challenge framework #

Let’s talk specifics about this challenge.

I’m starting with $25,000 of my own capital. Not a small amount of money, but also not so much that a few bad trades would be catastrophic (and with proper risk management, the danger of truly blowing up the account will be minimized as much as possible).

The objective is straightforward — beat the S&P 500 benchmark in 2025.

The timeline runs from March 2025 through December 2025.

Why March?

I’ll be in Taiwan for all of February, and given the 12-hour time difference with US markets, I’d rather focus on sleeping than trading.

Sleep-deprived trading is a special format of self-sabotage that I’m keen to avoid.

Monthly performance updates #

Transparency is core to this challenge.

At the end of each month, I’ll publish detailed performance metrics, including:

- Account value (the bottom line every wants to know) — I’ll screenshot my brokerage statement and post it here

- Number of trades executed

- Win percentage (how often I’m right)

- Average gain/loss per trade

- Average return per trade

- Win/loss ratio

These aren’t just vanity metrics — they’re key indicators of strategy performance and risk management effectiveness.

Each metric tells a different part of the story:

- A high win percentage might look good, but what if the losses are larger than the wins?

- A low number of trades might indicate patient selectivity, or it might suggest excessive prudence and missed opportunities

- The win/loss ratio helps us understand if we’re truly capturing meaningful moves in the market

By sharing these metrics monthly, you’ll get an unfiltered look at what building a quantitative trading operation actually looks like — both the victories and the inevitable defeats.

No cherry-picking good months. No hiding the drawdowns. You see it all, nothing hidden.

My trading approach #

I use a hybrid approach that combines algorithmic analysis with discretionary trading.

Here’s how it works:

90-95% of the research phase is automated. My algorithms scan the market, automatically analyzing potential setups and opportunities.

And, like other algorithmic approaches, my system crunches through data, looking for specific patterns and conditions that have historically provided favorable trading scenarios.

But here’s the key difference between my approach and fully automated trading:

I make all final trading decisions discretionally.

Why?

First, markets are dynamic, complex systems. While algorithms excel at processing data and identifying patterns, they can can overfit, and they can’t always account for the nuanced context that influences market behavior.

Sometimes, the best trade is the one you don’t take.

Secondly, I focus primarily on swing trading, meaning positions are typically held for a few days to a few weeks, and don’t require millisecond-level precision to profitably execute on them.

This approach allows me to:

- Maintain a limited number of active trades

- Give positions room to breathe and develop

- Avoid the stress (and costs) of day trading

- Have a life outside of watching charts all day

Starting simple: Large-cap and mega-cap focus #

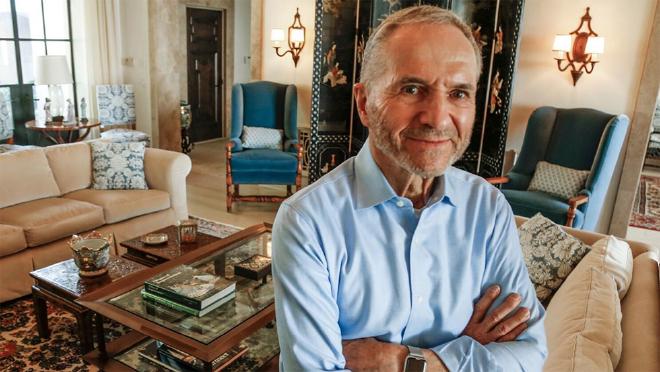

As Edward Thorpe wisely noted in A Man for All Markets — walk before you run.

I’m starting with mega-cap and large-cap stocks for several reasons:

- Lower volatility compared to mid-caps and small-caps

- Better liquidity for entering and exiting positions

- More stable price action, making patterns (theoretically) more reliable

- Reduced risk of gap events, thus destroying stop losses

Could I potentially make larger returns trading more volatile instruments?

Yes, of course!

But I’d rather build a solid foundation first.

The goal isn’t to hit home runs — it’s to develop a sustainable, repeatable process that can be scaled over time.

Speaking of scaling, once I’ve demonstrated consistent performance with large-cap and mega-cap, I’ll gradually expend into:

- Mid-cap stocks

- Different position types

- Additional trading instruments

But that’s getting ahead of ourselves…

My risk management framework #

Let me be crystal clear:

My primary goal isn’t to make as much money as possible — it’s to not lose money in the first place.

Here are the non-negotiable rules I follow.

Position sizing and risk limits #

- Each trade risks no more than 1-2% of the total portfolio

- Every position must have a defined stop loss before entry

- All trades have predefined target exit zones and take profit points

- Maximum portfolio risk at any time is capped at 20%

Why such strict rules? #

I can hear the critics bemoaning:

“Hey Adrian, where’s the ’to the moon’ mentality? The YOLO trades? The ’letting it ride’ philosophy so popular in crypto?”

Here’s the thing:

I’m not building a TikTok channel (besides, they are banned in the US now) — I’m attempting to build a sustainable trading operation.

Managing drawdown is critical for several reasons:

- Psychology: Small losses are easy to recover from. Big losses can lead to emotional trading, and even bigger losses.

- Compounding: You need a 100% gain to recover from a 50% loss. The math of recovery gets ugly fast.

- Future scaling: If I ever decide to manage outside capital, investors will care far more about how I protect their money than how much I made that one time I got lucky (at least the investors I seek will think that way)

I’ve seen too many traders blow up their accounts because they didn’t respect risk management. They might make amazing returns for awhile, but eventually, the market humbles everyone.

This isn’t about getting rich quick; it’s about building something that lasts.

And in trading, longevity comes from managing risk first, returns second.

Transparency and accountability #

The trading space has a transparency problem.

Scroll through Twitter/X, Instagram, Bluesky, YouTube, etc., and you’ll find endless screenshots of winning trades.

But losing trades?

Those mysteriously never make the highlight reel.

I’m taking a different approach — complete transparency.

At the end of each month, I’ll publish:

- Actual brokerage statements showing account performance

- Detailed trade metrics (listed earlier in this article)

- Market analysis explaining what worked, what didn’t, and why (or at least my take on “why”)

No cherry picking results. No hiding losses.

If I have a bad month (and I will — everyone does), you’ll know about tit.

Why this level of transparency? #

Two reasons.

First, I believe sunlight is the best disinfectant.

The trading industry is plagued with fake gurus selling dreams instead of reality.

By sharing everything — the good, the bad, and the ugly — I hope to set myself apart and show what building a trading operation actually looks like.

Second, public accountability is a powerful motivator. Knowing that I have to report my results each month ensures I stay disciplined and follow my rules.

Looking ahead #

While the $25,000 challenge is the immediate focus, I’ve got bigger plans in mind.

The 2025 roadmap #

Here’s how I see this year unfolding:

- Q1-Q2 (January-June): Focus exclusively on mega-cap and large-cap stocks. The goal here is simple: prove the strategy works consistently with the most stable instruments before adding additional complexity.

- Q2-Q3 (July-September): If I’m happy with performance, I’ll begin carefully expanding into mid-cap stocks. This opens up more opportunities but also introduces more volatility — hence why we walk before we run.

- Q3-Q4 (October-December): Explore additional instruments and position types. But only — and this is crucial — the core strategy has demonstrated consistent profitability.

The bigger picture #

This challenge isn’t just about trading $25,000.

It’s about building something larger:

- A sustainable trading operation

- Proven strategies that work in various market conditions

- Robust risk management systems

- Scalable infrastructures for future growth

- Potential fund management

- Building a track record that could (one day) attract outside capital

- An educational resource

- Sharing real experiences, not theoretical concepts

- Teaching others how to develop systematic trading approaches

- Building a community of thoughtful, risk-aware trades

I’ve been down this road before with PyImageSearch — starting small, focusing on quality, and gradually building something meaningful.

The instruments may be different at PythonFinTech, but the principle remains the same:

Create something valuable, be transparent about the process, and help others learn along the way.

Will everything go according to plan?

Probably not, nor do I expect them to.

Markets have a way of humbling even the best-laid plans.

But that’s exactly why I’m sharing this journey publicly — to show what building a quantitative trading operation really looks like, complete with all the pivots, setbacks, and lessons learned along the way.

Join me in the journey #

I’m putting $25,000 of my own money on the line.

Real trades. Real code. Real results, losses and all.

(P.S. I promise not to sell your data to Citadel)