Why I'm betting on Rush Street Interactive (RSI) as the strongest stock on my radar

Table of Contents

I’m already up 1.87R on this trade, and if another solid entry presents itself, I’m ready to add more.

In this article, I break down why RSI is the strongest stock on my radar right now.

What does Rush Street Interactive (RSI) do? #

Rush Street Interactive, founded in 2012 and headquartered in Chicago, operates in the rapidly expanding online gambling industry with both digital and physical presence.

While they started with traditional casinos, their primary growth engine has been online gambling platforms across the US and Latin America, strategically expanding as more states embrace legalization.

Fun fact: When I lived in Philadelphia, there was a Rivers Casino (owned my RSI) a ten minute walk from my house. Not that proximity to my former residence is a valid investment thesis, but I can confirm that the parking lot was packed most nights.

A quick note about gambling #

I’m not here to debate whether online gambling (or gambling in general) is ethical and moral.

Growing up in a broken household, I saw the darker side of gambling firsthand.

My dad loved to bet the horses, and I spent many weekends as a kid in off-track betting facilities, surrounded by desperate men with racing forms and crumpled tickets.

I don’t condone gambling, nor do I gamble myself. There’s a profound difference between what I do in the markets and putting money on the roulette wheel.

Anything I do in the stock market is based off of careful analysis backed by data, patterns, and algorithms.

I never risk more than I’m willing to lose, and I practice very strict risk/reward measures that keep emotion out of the equation (as best as possible).

Whether or not online gambling is moral isn’t relevant here — the fact is, it’s legal in the United States, RSI is operating within those legal boundaries (as far as we know), and if the stock presents an opportunity to grow my funds capital, I have no problem taking advantage of it.

Just as I might invest in a brewery without being a drinker, or a pharmaceutical company without taking their medications, I can recognize a solid investment opportunity in RSI without endorsing gambling as a pastime.

Why I entered the Rush Street Interactive position #

Let’s break down my entry to RSI, a stock that I’ve been tracking closely the past six months.

Daily technical analysis #

August through November 2024 had shown stiff resistance for Rush Street Interactive around $11.63 with multiple price rejections before the price pushed through on high volume in mid-November:

This movement coincided with strong earnings and revenue (beating projections) at the beginning of November.

I had been looking for an entry to RSI and found my opportunity during the last week of January:

Breaking it down:

- Friday, Jan. 24th: RSI traded down to its daily 50MA.

- Monday, Jan. 27th: The daily 50MA held for a second day in a row, with the Stochastics RSI technical indicator (not the company, I know that’s confusing) showing heavily oversold conditions.

- Tuesday, Jan. 28th: Slight upwards movement on higher volume.

- Wednesday, Jan. 29th: I enter the trade on a tight-wicked doji candle (typically used to indicate “market indecision”), convinced that the “indecision” would resolve in the uptrend continuing.

Then, a few days later, on February 4th, RSI moves upwards again on significant volume:

The daily 50MA is retested on Friday, February 7th and once again holds, printing a new higher low (allowing the trend line to be drawn) and forming a near perfect hammer candle.

On Monday, February 10th another hammer-like candle formed on high volume, finding support on top of the daily 50MA.

Weekly technical analysis #

The weekly chart shows clear momentum, with RSI trading above both its weekly 10MA and 40MA since early 2024:

However, despite its positive momentum, RSI had been flirting (unsuccessfully) with breaking through its 0.5 Fibonacci retracement level since late November.

The market repeatedly rejected upward moves until:

- Its weekly 10MA held (again, on high volume) the week of February 3rd

- The 0.5 retracement level was defiantly broken through the week of February 10th

Also, take note of the forming confluence between the weekly 10MA and the 0.5 retracement level — this is the target area to add to my position.

It’s my thesis that, if RSI retraces to this level, and the confluence holds, that the former resistance level will turn to support and a new base will form, allowing RSI to grow further.

Solid fundamentals #

This isn’t just a technical play — the fundamentals look equally enticing.

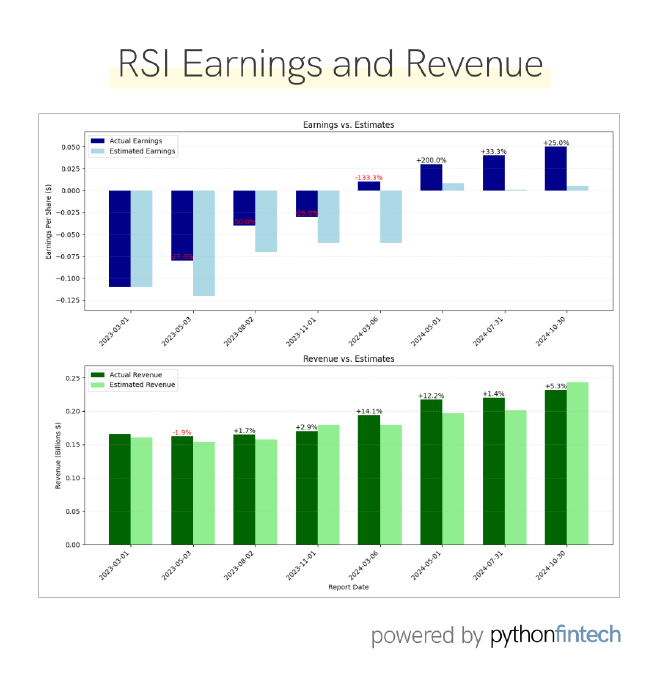

RSI’s earnings have been consistently outperforming projections by an average of 225%, forming a strong upward trend, with revenue telling a similar story:

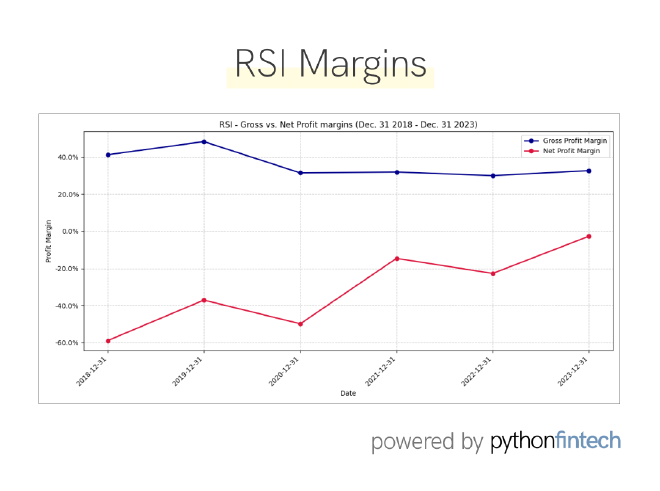

And when we look at the profit margins, we can see net profit margins increasing, implying that the company is becoming more profitable over time:

Earnings projected to increase 800% (or more) in upcoming announcement #

According to Zacks Equity Research (source):

RSI’s earnings for the to-be-reported quarter are expected to increase 800%. It reported earnings beats in each of the trailing four quarters, the average surprise being 225%.

If earnings once again beat projections, RSI could be ready to ride a massive wave upwards.

Bullish call options sweep #

Adding fuel to the fire, options activity suggests other traders are placing big bets on RSI (Benzinga Insights):

For RSI (NYSE:RSI), we notice a call option sweep that happens to be bullish, expiring in 39 day(s) on March 21, 2025. This event was a transfer of 293 contract(s) at a $12.50 strike. This particular call needed to be split into 45 different trades to become filled. The total cost received by the writing party (or parties) was $73.2K, with a price of $250.0 per contract. There were 5906 open contracts at this strike prior to today, and today 296 contract(s) were bought and sold.

Effectively, someone just made a big, confident bet on RSI going higher.

When a trader does a “call option sweep”, splitting their order into 45 different trades, it’s like watching someone sprint through a casino throwing chips at the same number on multiple roulette tables.

These aren’t lottery ticket calls either — they’re buying at the $12.50 strike when RSI is trading $14-16. That’s like betting a race horse will finish the track when it’s already 3/4 of the way there. Conservative, but conviction-heavy.

The $73.2K position with a March expiration tells me this isn’t some day-trader gambling with their stimulus check either.

This looks like smart money positioning for the earnings catalyst while giving themselves runway if timing isn’t perfect.

I agree with whoever this trader is — RSI looks poised to go on a massive tear.

Upcoming earnings…ready to push RSI even higher? #

Rush Street Interactive reports earnings on Wednesday, February 26th, 2025 (just a week away).

With analysts projecting 800% earnings growth, this could be the catalyst that sends the stock significantly higher.

Of course, earnings are also when stocks can do their best impression of a cliff diver with rocks in their pockets — but with my stop loss close to break-even, I’m comfortable holding through the announcement.

If RSI delivers anywhere near those projections, we could see a substantial gap up and continuation of the bullish trend.

If the earnings disappoint…well, that’s why we have stop losses, therapy, and bubble tea.

My plan going forward #

I’m looking to increase my position (i.e., open another long trade) if:

- RSI pulls back and holds at the daily 50MA, weekly 10MA, and 0.5 Fibonacci retracement level, implying a strong level of confluence and support

- We see another bullish candlestick pattern form towards the bottom of the correction

- Volume remains strong on advances

My (ideal) target for this trade is around $20-22, which would represent a move past the 0.618 Fibonacci level and provide about 6-8R total return (regardless if I add to my position or not).

Final thoughts #

When it comes to trading, I’ve learned that combining strong technicals with powerful fundamentals while managing risk appropriately gives you the best chance for success.

RSI currently checks all these boxes for me:

- ✅ Bullish technical setup with clear support

- ✅ Strong fundamental growth projections

- ✅ Risk management in place (break-even stop)

- ✅ Upcoming catalyst (earnings)

- ✅ Clear areas to add to the position if the opportunity presents itself

Is this trade guaranteed to work?

Absolutely not.

Nothing in trading is certain except transaction fees and the occasional bout of existential dread while staring at candlestick charts at 2AM.

But with the risk/reward profile and my current risk-free position, Rush Street Interactive represents one of the most compelling opportunities I’ve seen in months.

I’m betting on its continued success, both literally and figuratively.

Now if you’ll excuse me, I need to go explain to my accountant why I still don’t want to “just buy index funds like a normal person.”

Disclaimer: This is my trading journal, not your personal investment guide. Think of it like watching someone's cooking show — just because I'm making pad thai doesn't mean you should too (especially if you're allergic to peanuts). Sometimes I hold positions in the stocks I write about (shocking, I know). But that doesn't mean you should copy my trades and YOLO your life savings. Do your own research, consult actual professionals, and never trade more than you can afford to lose.