Just opened a long position on CLS (why I'm bullish on Celestica Inc.)

Table of Contents

Look, I know I said I wouldn’t start my $25K trading challenge (where I attempt to outperform the S&P 500) until after my trip to Taiwan.

I promised myself I’d wait.

But then DeepSeek happened, the internet lost its mind, and the market reacted like my drunk uncle at Thanksgiving — swinging wildly in every direction.

Chip leaders like NVIDA (NVDA) and Broadcom (AVGO) took massive hits, and I saw an opportunity I couldn’t pass up.

Translation? Time to go shopping for oversold stocks.

One of the trades I took was a long position on Celestica (CLS) — one of my favorite large-cap stocks in the Information Technology sector.

Let’s talk about why I took this trade.

What does Celestica Inc. do? #

(Besides make me money)

At its core, Celestica is a hardware platform and supply chain solutions provider.

They are the ones who:

- Design and build the actual hardware that helps make all the fancy AI and cloud computing possible

- Handle the complex supply chain management that keeps tech giants running

- Create everything from routers and switches to servers and storage solutions

- Manufacture specialized electronic components that go into products you potentially use daily

Celestica operates in two key segments:

- Advanced Technology Solutions (ATS) — Serving aerospace, defense, industrial, energy, and health-tech sectors.

- Connectivity & Cloud Solutions (CCS) — Providing infrastructure for data centers, enterprise networking, and edge computing.

Essentially, they are the behind-the-scenes muscle that keeps high-tech industries running smoothly.

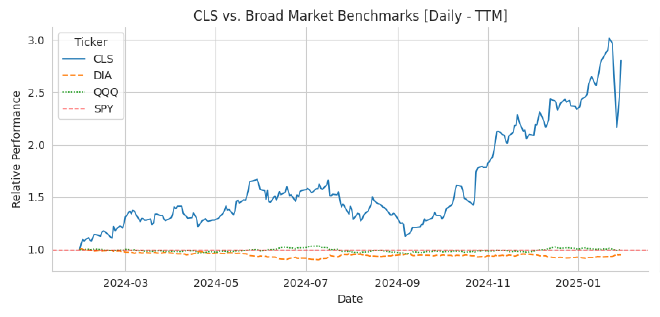

CLS has outperformed the S&P 500 by ~300% over the past 12 months #

Celestica has been destroying the broader market.

Over the past trailing twelve months (TTM), it’s outperformed the S&P 500 by nearly 300%, placing it in the top 1% of stocks by relative performance.

Then, the DeepSeek announcement happened, and suddenly, investors started questioning the future of AI infrastructure:

- If state-of-the-art Large Language Models (LLMs) can be trained and deployed more efficiently, will GPU chips still be in high demand?

- If fewer chips are being used, will the need for data centers decline?

- And if that happens…what does that mean for companies that provide hardware and cooling solutions for these data centers?

All of these are valid concerns — but it was my belief that the market reaction following the DeepSeek announcement was overblown.

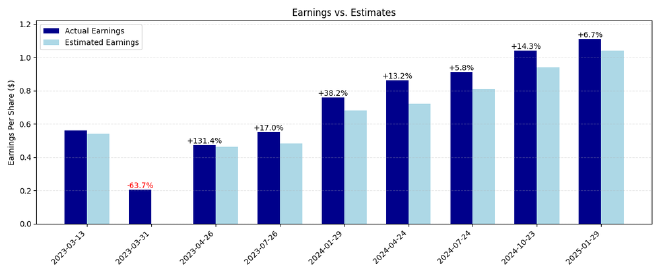

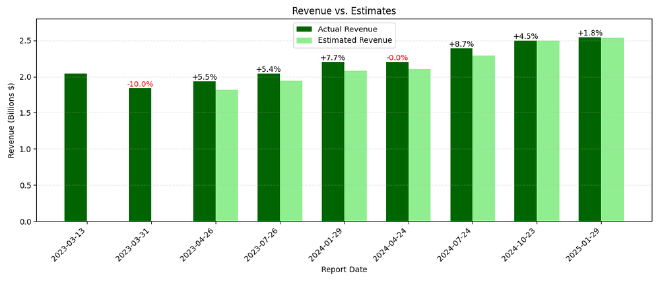

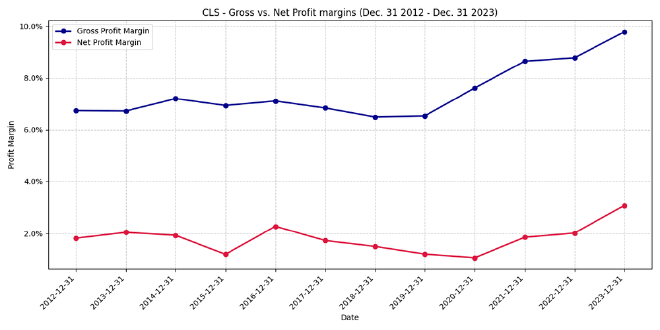

Celestica has incredible earnings and revenue, consistently growing and beating projections #

Since April 2023, CLS has been on steep upward trajectory.

Let’s break it down.

First, Celestica has beaten earnings projections quarter after quarter:

Revenue is telling the same story, with steady upward momentum:

And in terms of profit margins, both gross profit margins and net profit margins are steadily increasing, implying that Celestica is becoming more efficient and more profitable over time:

Ranking CLS by performance and fundamentals #

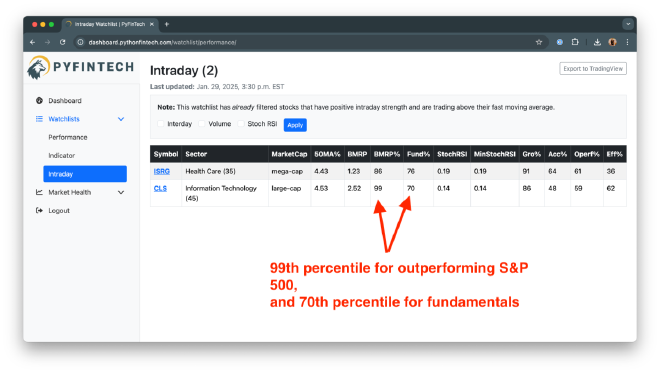

According to my algorithm analysis, Celestica ranks in the 99th percentile for outperforming the S&P 500, and lands in the 70th percentile for overall fundamentals.

Translation: This is a fundamentally strong company and a technical outlier in terms of performance.

The setup — why I pulled the trigger on CLS #

Here’s where it gets interesting (and by interesting, I mean where I actually put my money where my mouth is):

- Monday (Jan. 27 2025): CLS takes a nosedive after the DeepSeek announcement, dropping below its 50-day moving average.

- Tuesday (Jan. 28 2025): Stock finds support, closes higher than open

- Wednesday (Jan. 29 2025): Stock is heavily oversold, gaps up over the 50MA on high volume — this is when I opened my position

Looking at the weekly chart, CLS wicked down below its 10-week moving average (10MA) but quickly rebounded, confirming strong support:

Celestica hit 3R within 24 hours — locked in profit #

On January 29th (the same day I opened the trade), Celestica reported earnings and revenue, gapping up in after hours trading.

By market open on Thursday, January 30th, CLS was up nearly 16%, reaching my 3R profit target (3x my initial risk).

Here’s how I managed it:

- Sold 50% of my position at 3R. This locked in a 1.5% portfolio gain.

- Moved my stop loss to break even. The rest of the position is now risk-free.

- Letting the remaining shares ride. If CLS keeps running, I’ll continue peeling off profits.

Final thoughts #

The reaction to the DeepSeek announcement created a temporary buying opportunity in Celestica. The fundamentals are strong, the technicals aligned, and the risk/reward made sense.

I’m now in a partial free trade in under 24 hours — meaning even if the stock reverses, I walk away with a win (because nobody ever went broke taking profits).

Disclaimer: This is my trading journal, not your personal investment guide. Think of it like watching someone's cooking show — just because I'm making pad thai doesn't mean you should too (especially if you're allergic to peanuts). Sometimes I hold positions in the stocks I write about (shocking, I know). But that doesn't mean you should copy my trades and YOLO your life savings. Do your own research, consult actual professionals, and never trade more than you can afford to lose.